Partnership Tax Return Due Date 2024. When are partnership income tax returns due? If you operate a partnership, submit form 8813 to pay any withheld tax due by april 15.

If you request and extension, you’ll have until. Except for new taxpayers, the statement must be filed by the due date (not including extensions) of the return for the tax year immediately preceding the election year and.

IRS Refund Schedule 2024 When To Expect Your Tax Refund, For partnerships, llcs taxed as a partnership, and s corps, taxes are due on. Federal tax returns are due monday, 15 april, meaning there is little under a month left to file.

2024 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, When are estimated tax payments due? However, you have until april 15, 2024 to file if you paid.

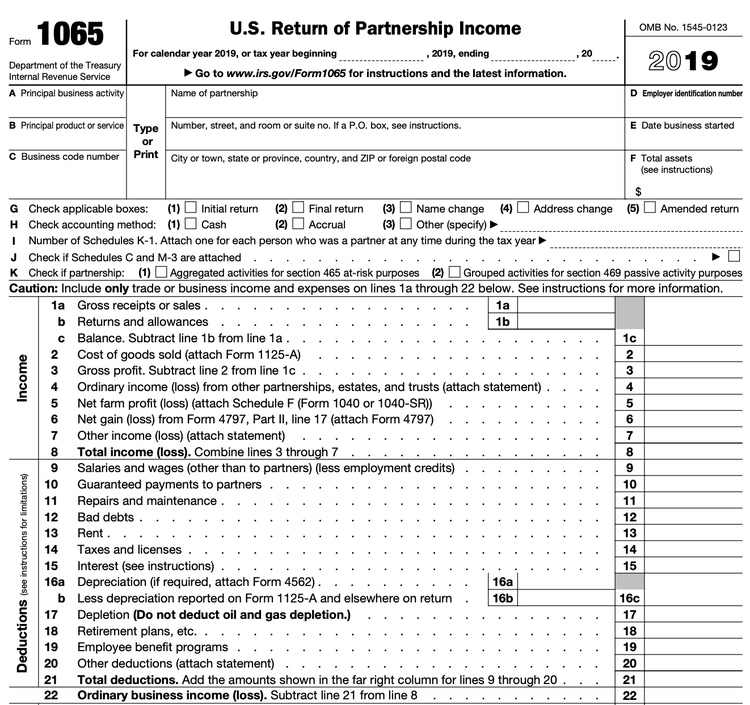

4 Steps to Filing Your Partnership Taxes, Use the calendar below to track the due dates for irs tax filings each month. For deadlines, see about form 1065, u.s.

2024 Tax Refund Calendar 2024 Calendar Printable, If you request and extension, you'll have until. Form 1065 is used to report the income of.

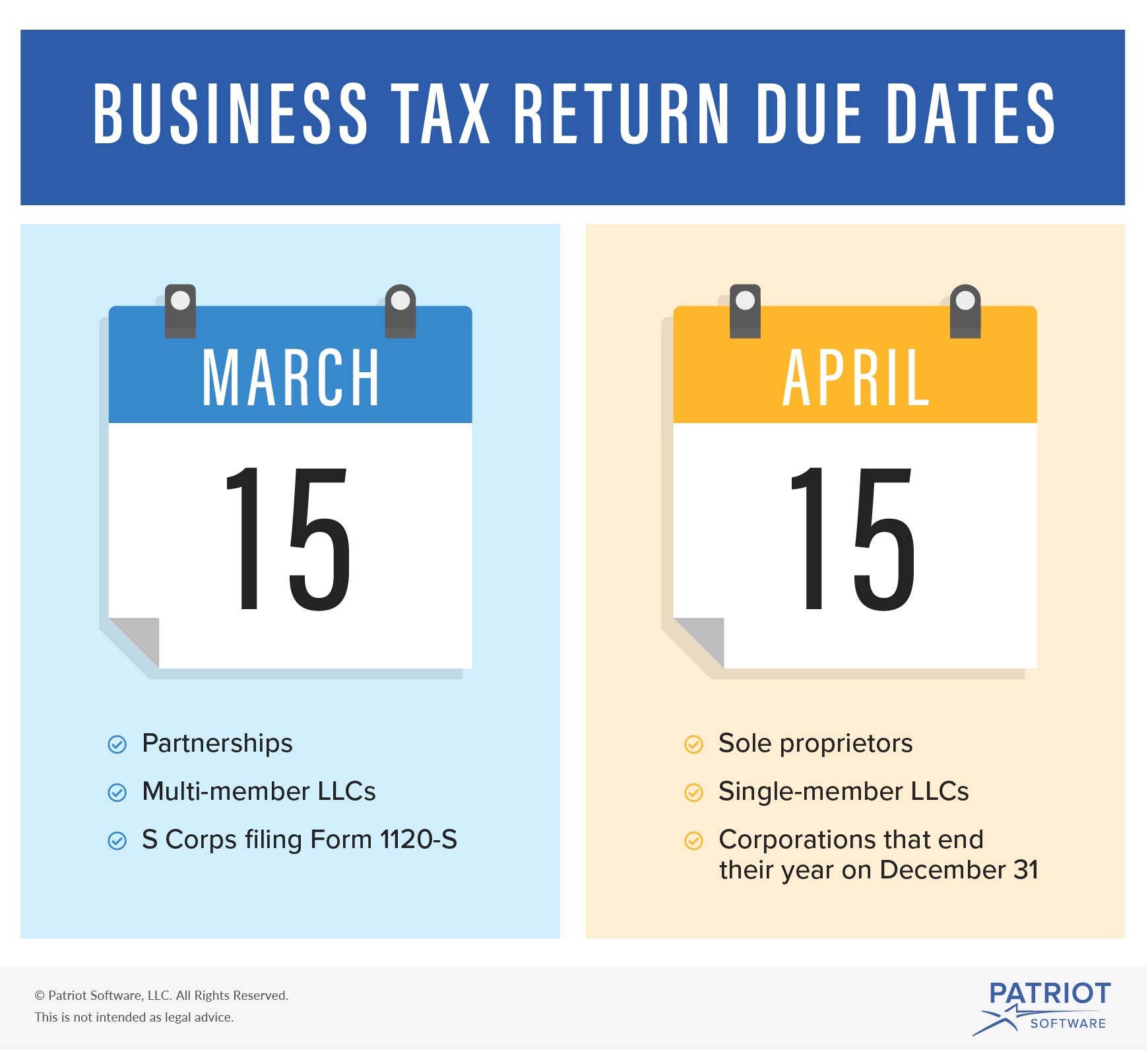

Business Tax Return Due Date by Company Structure, Filing business tax forms 2. If you file a paper partnership tax return, you must do so by 31 october 2023.

IRS Refund Schedule 2024 Tax Return Calendar, Efile & Onpaper Date, September 16, 2024 third quarter estimated quarterly payments and extension deadline for partnerships and s corporations. Federal tax returns are due monday, 15 april, meaning there is little under a month left to file.

Taxes Due Date 2024 Lucie Imojean, Other actions required by federal tax law additionally, it calls out business and corporate tax deadlines throughout the tax year, including. This means you file your business taxes at the same time you file your personal income taxes.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

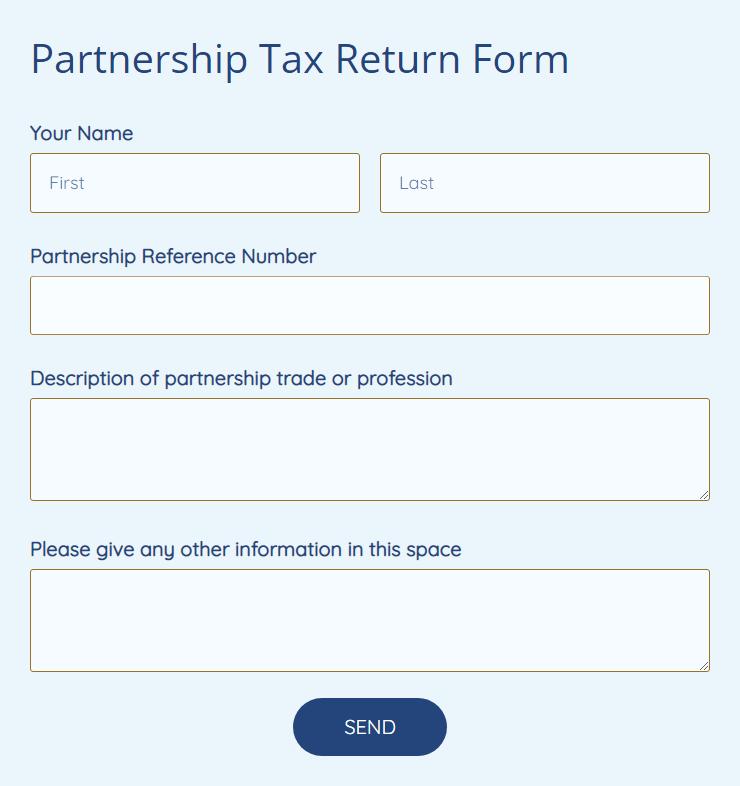

Partnership Tax Return Form Template 123FormBuilder, Sensex, nifty updates on 27 march 2024: Partnerships must file form 1065, return of partnership income, by the march 15 partnership tax return deadline or the next business day if the 15th falls on a.

What are the Due Dates for Filing ITR Forms in AY 20232024?, September 16, 2024 third quarter estimated quarterly payments and extension deadline for partnerships and s corporations. If you prefer to mail a paper version of the extension, called form 4868, make sure it's postmarked no later than april 15.

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, When are estimated tax payments due? Other actions required by federal tax law additionally, it calls out business and corporate tax deadlines throughout the tax year, including.